Inflation is cooling down, reason for a party?

The US inflation figures were announced on Wednesday, as short as possible: better than expected. Reason for a party? Not exactly if we look at the autocorrelation of inflationary components. The autocorrelation of inflation components is very important to check. What is ‘autocorrelation’? It is simply a question of how much CPI items are accelerating or decelerating in price.

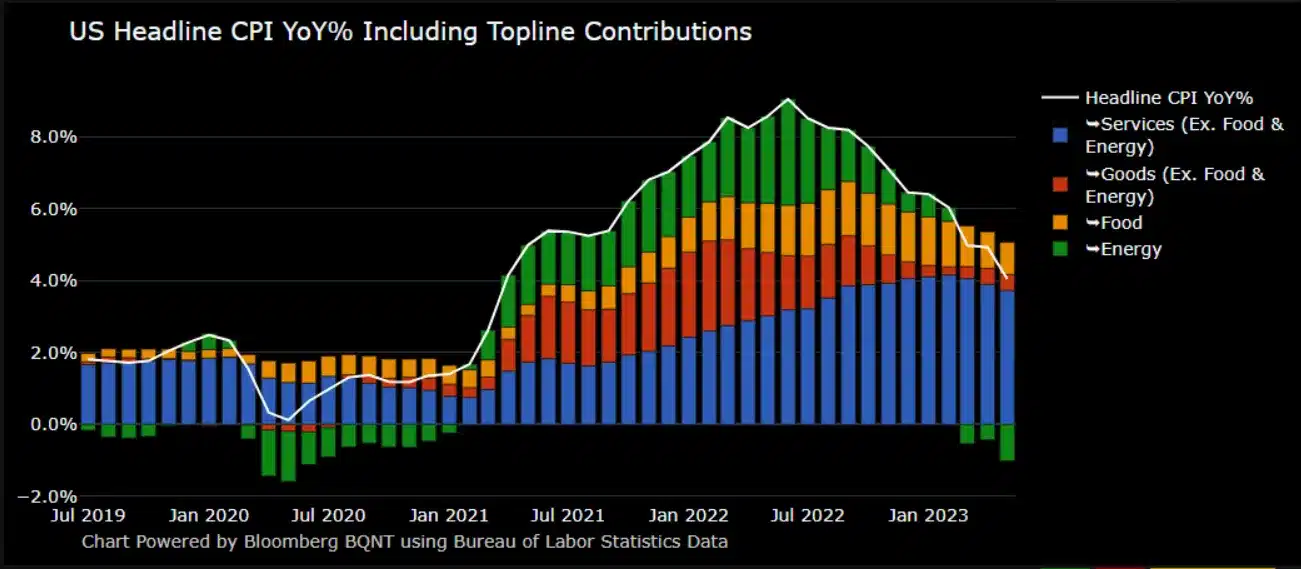

For example, these are the main components of CPI:

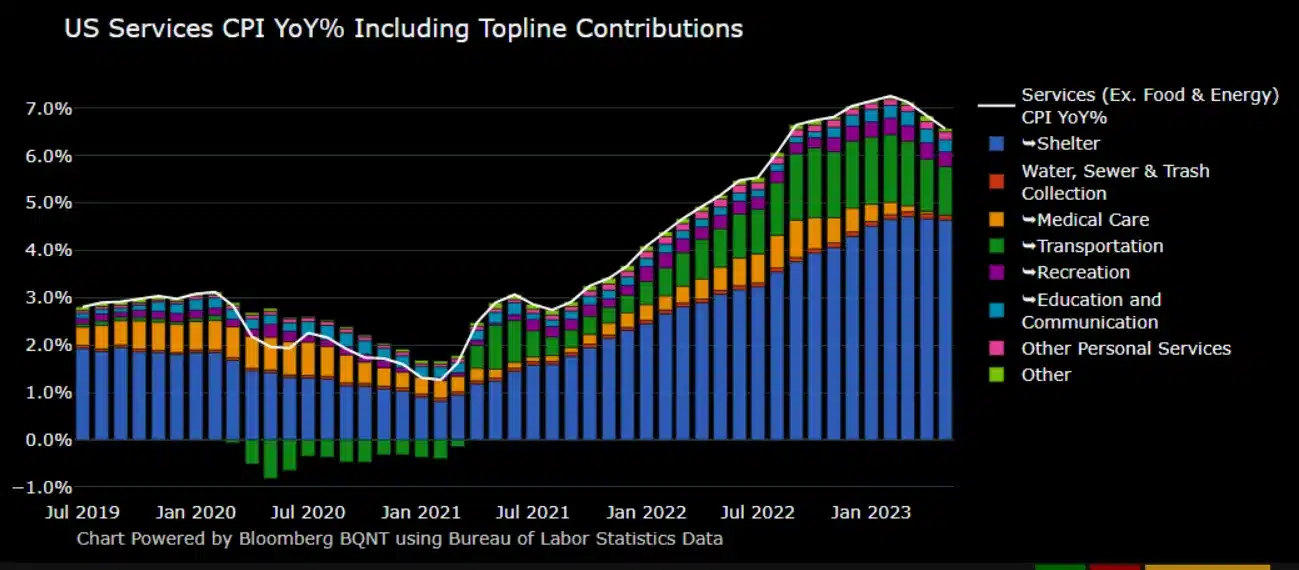

We can break down each of these components into their sub-components. Here is the service component:

Most people, even economists, only look at CPI (Consumer Price Index) and core inflation, a ‘thermometer’ of course, but one that doesn’t reflect reality. Most will notice it in their wallet. Inflation is so complex in nature that it cannot be accurately expressed in a number. Looking at the underlying autocorrelation of the CPI items may give you a better idea of CPI and its complexity.

Part of the reason autocorrelation is important to understand is because of how inflation is transferred through the economy. Inflation is never evenly distributed across the economy. Once many CPI items start accelerating, they begin to create a self-feeding reflexive feedback loop, aka a vicious circle.

For example, if my energy and food bills go up, I’m going to ask my boss for a raise. As soon as he raises my wages, he raises the price of his goods and services. Then the people who buy his stuff go to their boss and ask for a raise. This is starting to work its way through every sector and every CPI item of the economy. Sometimes inflation is only in a single sector due to an imbalance between supply and demand, but when it starts to affect all sectors, it can start to feed on itself.

We now know that headline inflation has slowed significantly as a result of the energy component. However, this is only one part of the economy. Commodities are not responsible for the entire price distribution in the economy.

Gold and silver take the profits

Regardless of whether or not the Fed should raise rates from 5.25%, they are still likely to raise again, even as we end the week with a core CPI below the Fed rate. Don’t forget that Powell has been using rhetoric all the time about siding with ‘tightning’ over ‘loosening.’

In any case, gold and silver benefit greatly from declining inflation figures. After the announcement of the US figures, gold is just under 1.5% higher and silver is more than 4%. Investors expect that once inflation begins to cool significantly, there is a greater chance that the Fed will cut interest rates incrementally, which is good for gold as the US dollar will lose ground in that case. Both metals seem to have found their bottom. Gold at $1,900 an ounce and silver at $22 an ounce.

If you buy precious metal, make sure that it is physical gold and physical silver that is stored under your name. A second important point is the buy-back guarantee. If there is no buy-back guarantee at a fixed price, you do not know what you will receive when you sell your precious metal.

At Doijer & Kalff you always buy physical precious metals that are stored under your name, with a buy-back guarantee at a predetermined price.

Views based on published articles or news items are purely informative. The non-binding information should not be perceived as an offer, investment advice or any other financial service.

Sign up now for our newsletter and receive daily updates on precious metals, our discounts and articles.