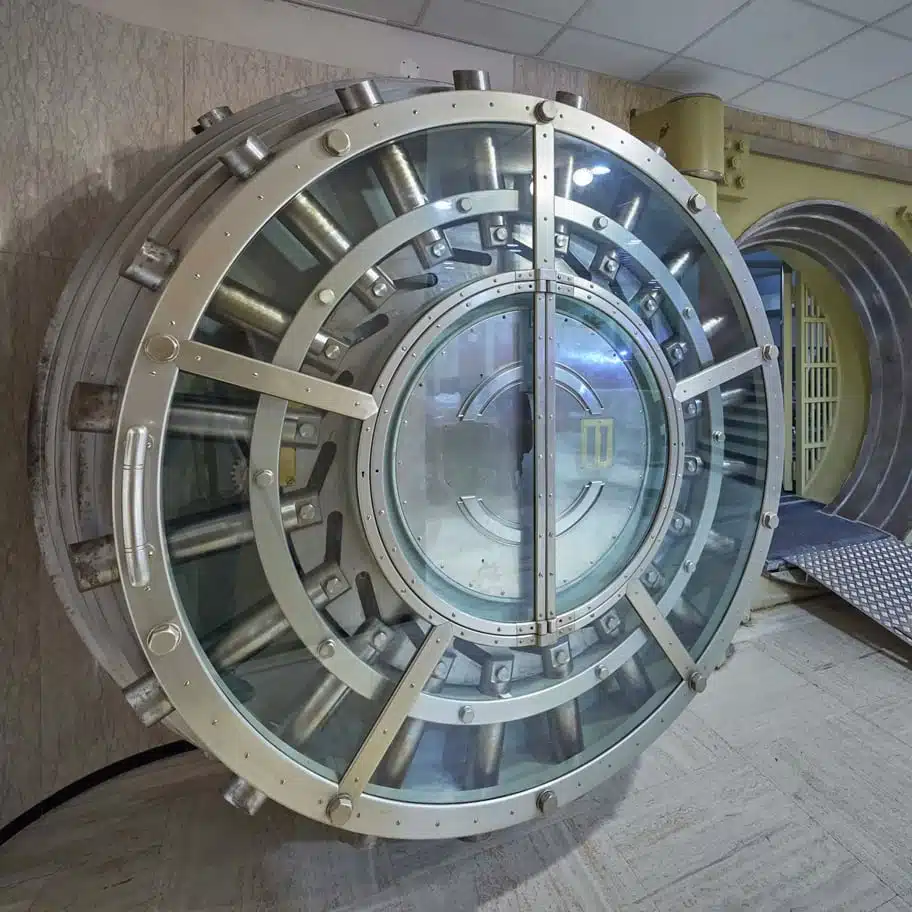

With a DKgold account you are able to buy gold in a secure and safe way. The most profitable way is by purchasing gold bars. On average, gold bars are 7% better priced than gold coins. The gold bars are stored in your name in one of the securest vaults in the world, at Brink’s in Zurich, Switzerland.

DKgold offers wealth preservation since 1825.

Premium at purchase starting from €0.65 per gram

Upon selling, you receive until 99% of the price of gold

Storage costs amount to 0.6% of the replacement value annually, starting at €14.95 quarterly

Amounts include VAT, orders are possible from a weight of 10 grams

Most people who would like to save or invest their money buy gold as a protection of their purchasing power. The investment horizon for most investors is between the 5 and 10 years. In the past, investments in gold have been very profitable in the long run.

Considering the return on investment in physical gold, the figures of the past 20 years have been excellent. Since 2002, the price of gold has risen by an average of 9% annually. Gold, therefore, is a good alternative for maintaining a euro savings account. Fiat money, such as the euro, loses a part of its purchasing power every year. This is expressed in the inflation rate, which currently amounts to 10% annually.

The interest on a savings account should (normally) offset inflation. Unfortunately, this is not the case at this very moment. The so-called real interest rate (interest minus inflation) is therefore negative. As a result, the euro currently loses around 10% of its value annually.

And that is precisely the reason for an increasing number of individuals and entrepreneurs for buying gold. Since 1971, the price of gold has risen by an average of 8% annually. Gold enables them to protect their purchasing power and will increase their capital.

When buying gold there are also risks involved, such as the exchange rate risk. This means that the price could drop. In 2013, for example, the price of gold fell by 31%. When you are buying physical gold, you should carefully consider the risks involved.

Return on investment of physical gold, in euros:

Most central banks in the world own gold. This gold serves as an anchor in the monetary system. The gold stock provides a sense of security and creates confidence.

The three main reasons of our customers for buying gold are listed below.

Building up capital by means of putting your money in a savings account is currently not profitable. You are saving your euros while the ECB prints billions of them.

Due to this, it is better to build up capital in the form of physical gold to secure your financial future. The aboveground reserves of gold increase by a maximum of 2% annually.

Since 2004, the price of gold has risen by an average of slightly more than 10% annually.

Gold offers an excellent alternative to putting your money in a savings account.

Every year, you lose some 2 to 3% of your purchasing power due to inflation. In 2022, the inflation has even risen to 10%.

Fiat money is subject to inflation, gold on the other hand will keep your purchasing power intact.

During the past century, the purchasing power of the euro and the dollar has decreased by 98%.

This explains the general increase in prices: we need ever more money to be able to come up with the same value.

The financial crisis of 2008 caused a general drop of value, including the value of stocks, raw materials and real estate. But the price of gold went up!

By now, debts are much higher than in 2008. Sooner or later another crisis will hit. Buying gold is an excellent way of preparing for a crisis.

For this very reason, central banks own vast reserves of gold. Gold is still an anchor in the monetary system.

Our customers buy gold as an alternative for holding on to a capital in euros. By gold we mean physical gold!

Physical gold is scarce. The quantity of aboveground physical gold only increases by 2% every year. This makes physical gold a unique investment.

There are various ways of buying gold. You could buy gold-mining stocks, or an exchange-traded fund (ETF) or an option on gold in the form of a futures contract.

Gold-mining stocks

Investing in gold mines is highly speculative. During recent years, the number of discoveries of new underground gold reserves has plummeted, resulting in the steep rise of the costs of mining for gold (also called: all-in sustaining cost).

According to the most recent figures, the average cost of mining gold stands at $1693 per troy ounce. The rising costs of energy play an important role in this. Unfortunately, only few gold mines have yielded good returns.

During the past 20 years, the HUI (the index of companies involved in gold mining) has risen by 71%. During this period, the price of physical gold has increased by 474%. Buying physical gold is not only less complicated, it is also more profitable.

Gold ETF

You are able to buy gold through an ETF, which stands for Exchange Traded Fund. Buying a gold ETF does not automatically mean you actually own physical gold. More often than not your position is purchased by the fund in the form of a gold future. You could regard this as a sort of ‘paper promise’ of physical gold.

In the gold market, more gold is sold on paper than is actually physically available. For this reason, investors are keen on buying physical gold instead of so-called derivatives such as an ETF or a futures contract.

So make sure that when you are buying gold, you’re dealing with physical gold! With a DKgold account you will always buy physical gold. Our customers’ orders are purchased directly and delivered to the vault within a period of 2 to 3 weeks, where they will be stored in your name.

DKgold is the specialist when it comes to buying gold as an investment. At DKgold you are able to buy physical gold, which is then stored in your name in the vaults of Brink’s in Zurich, Switzerland.

To be able to use the services offered by DKgold, you could create an online account. This will allow you to buy your gold in a safe and secured manner.

The minimum weight of an order is 10 grams. With your online account you are able to track the position of your gold after this has been stored in the vault.

You are the legal owner of the gold. Through the dashboard of your account, you are able to monitor the position of your gold at any moment.

Do you wish to sell back the previously purchased gold? This is as easy and fast as buying gold. We will transfer the proceeds to your bank account and we will adjust your positions in the vault.

Selling only part of your gold is also a possibility. If, for example, you own 100 grams of gold, you could sell 30 grams and keep the remaining 70 grams.

Lastly, a convenient aspect of your online account: you will find your annual statement and the allocation number of your gold bars via the dashboard of your account. This gives you a continuous overview of your assets.

DKgold offers you a convenient, safe and fast way of buying and selling gold!

If you wish to buy gold combined with storage, it is important that you choose a reliable partner.

Doijer & Kalff was founded in 1825 as a small-scale and independent bank. Our core values have remained unchanged since then.

In 2010, Doijer & Kalff was continued by a group of private investors with respect for the reserved banking mentality of the past and established DKgold as our international branch.

By now, DKgold has more than 7000 customers who have bought, or are still buying, gold in combination with secure storage.

We offer you the possibility of buying physical gold in a safe manner and against very competitive prices. Your account with us combines the traditional aspect of having your physical gold safe in a vault with the ease of an online account.

Investment gold is exempt from VAT. With your account you are able to buy gold starting at 10 grams.

Our fee starts at €5.50 per 10 grams. We charge this fee for the production of the gold bar and its transportation.

WIth this we are able to offer you the best way of safely buying gold.

It is of the utmost importance that you always choose secured and insured storage, combined with a sell-back guarantee. Carrying gold with you while you’re out on the street is very risky.

In addition, it is not possible to insure the storage of gold at home (or in your office or anywhere else un-secured). And peace of mind during your holidays is what you want! .

Our sell-back guarantee ensures that you know which price you will receive when you choose to sell your gold (at any moment you wish).

When you would opt for storing your gold in some other location, this is not the case.

Secured and safe storage, starting at €14,95 per quarter.

When more customers are selling than buying gold, we have a surplus.

The SALE is only available when we have surplus stock. The fees during the SALE are lower because we have bought back gold from a customer, meaning that the bars have already been produced and transported. This allows you to buy gold against the most competitive prices in Europe!

The premium during the SALE is €2 per 10 grams.

Account holders receive an e-mail when more than 500 grams of gold has been added to the SALE.