Gold update: gold price to new record

Gold has had a strong performance in the last 10 years. The financial crisis in 2011 made people aware of so-called systemic risks. Money in the bank did not appear to be risk-free because savers run a so-called counterparty risk.

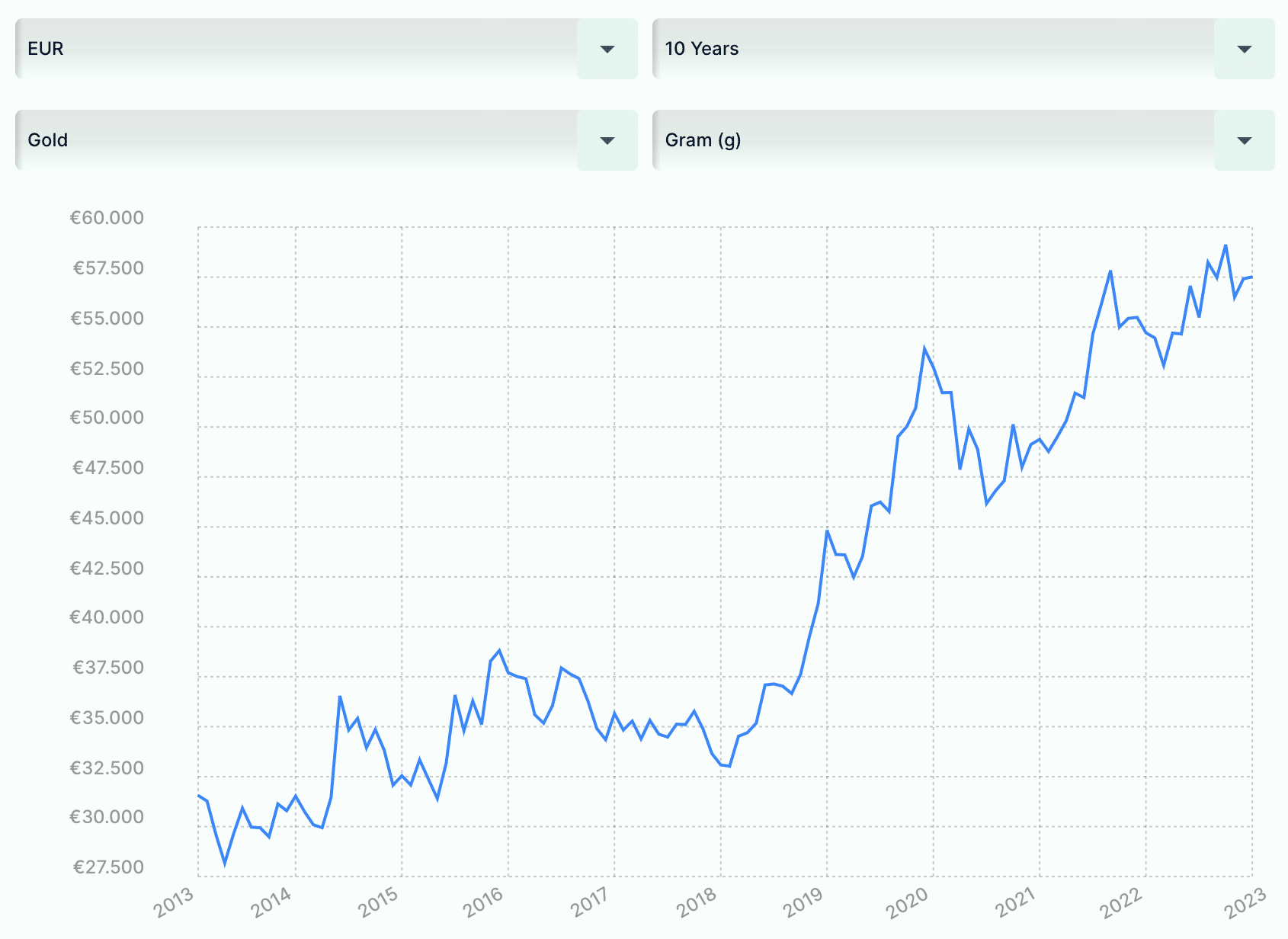

Central banks intervened by printing enormous amounts of extra money to support the system. This money creation has caused the gold price to rise sharply since 2011. That is exactly what we see when we look at the gold price graph over the last 10 years.

A kilogram of gold rose from €30,000 to a new record of €60,050 last Friday. The last record in euros was achieved in May this year. The top then was €59,781 per kilogram.

In US dollars, the gold price is now flirting with the $2000 level. The old record in US dollars dates back to August 2020. Due to COVID-19, gold acted as a safe haven for savers and investors. That month the gold price reached $2075 per troy ounce.

Gold has risen sharply due to the combination of monetary madness among central bankers in the last 10 years and recently added to the tensions in Ukraine and the Middle East. This cocktail has set the gold price in euros to a new record.

At Doijer & Kalff we saw a huge influx of new customers in March of this year. The reason was increased systemic risks when a number of American banks collapsed. Now, on top of that, a series of geopolitical developments mean that gold is chosen for what it does, namely providing protection in uncertain times.

Gold has risen by just under 10% in euros this year. Silver is still at a loss of more than 1%.

Agenda

Consumer confidence for October in the Netherlands will be announced on Monday. The composite purchasing managers index for October will be published on Tuesday. The ECB will make an interest rate decision on Thursday (at 2:15 p.m.). The ECB is expected to leave interest rates unchanged. The final consumer confidence figure for October in the US will be announced on Friday.

Views based on published articles or news items are purely informative. The non-binding information should not be perceived as an offer, investment advice or any other financial service.

Sign up now for our newsletter and receive daily updates on precious metals, our discounts and articles.