Don't be fooled - The importance of pricing in different currencies

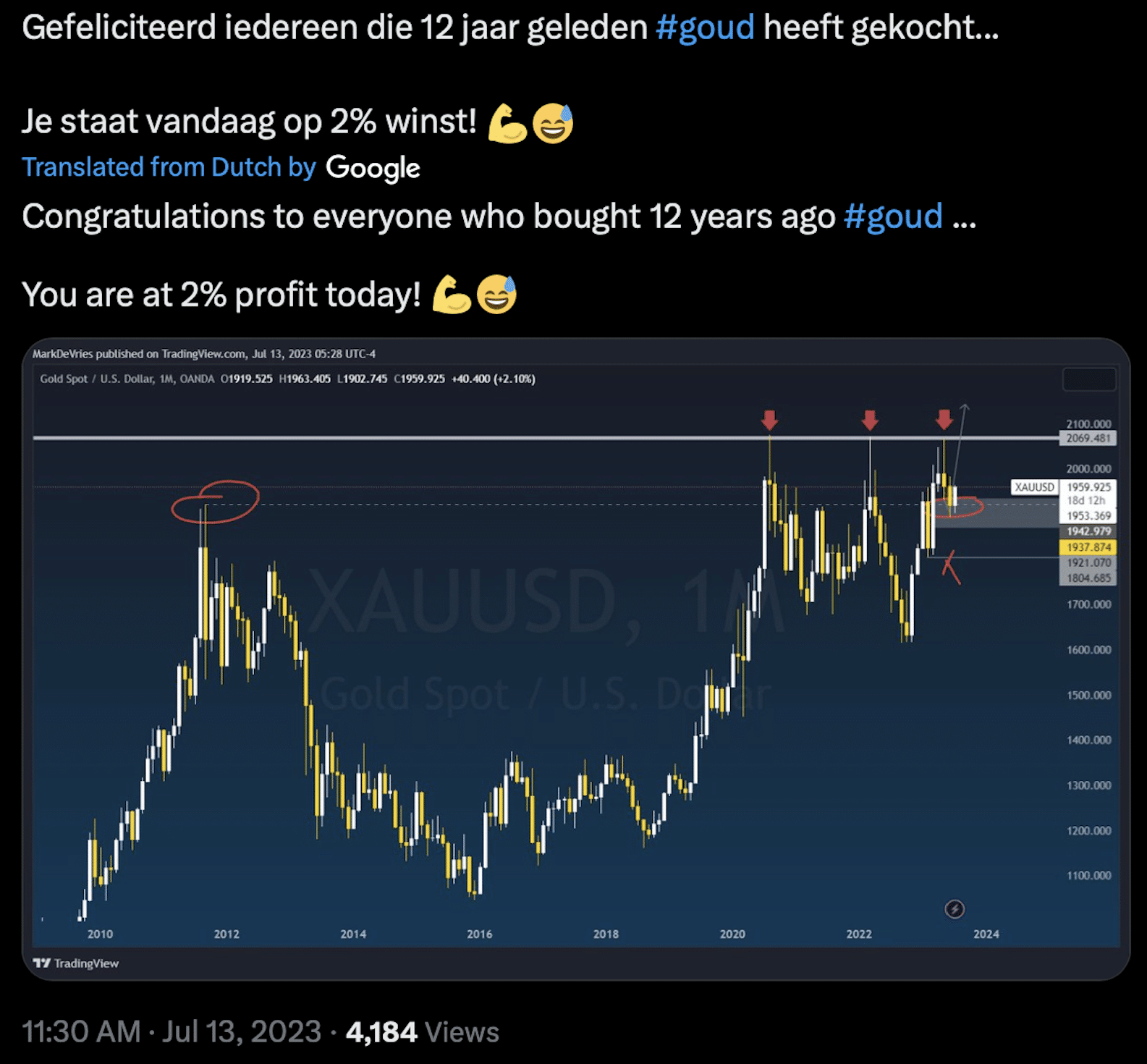

Last week I saw a tweet from someone who cynically shared that if one had bought gold 12 years ago, today it would be 2% profit. This is a trap that many fall into, by pricing assets in US Dollars. The value of gold never changes. The only thing that changes is the value of currencies. In fact, gold quoted in euros has since accounted for a 37% return and quoted in Turkish lira even 1.523%.

Now currencies move at different speeds, but nevertheless they all move together as a group against gold, which remains static. As such, the price of gold never “goes up,” but certain currencies depreciate faster. The pace of this depreciation is influenced not only by the relative strength of the currencies, but also by external factors such as interest rates, inflation, geopolitics and other crucial macro factors.

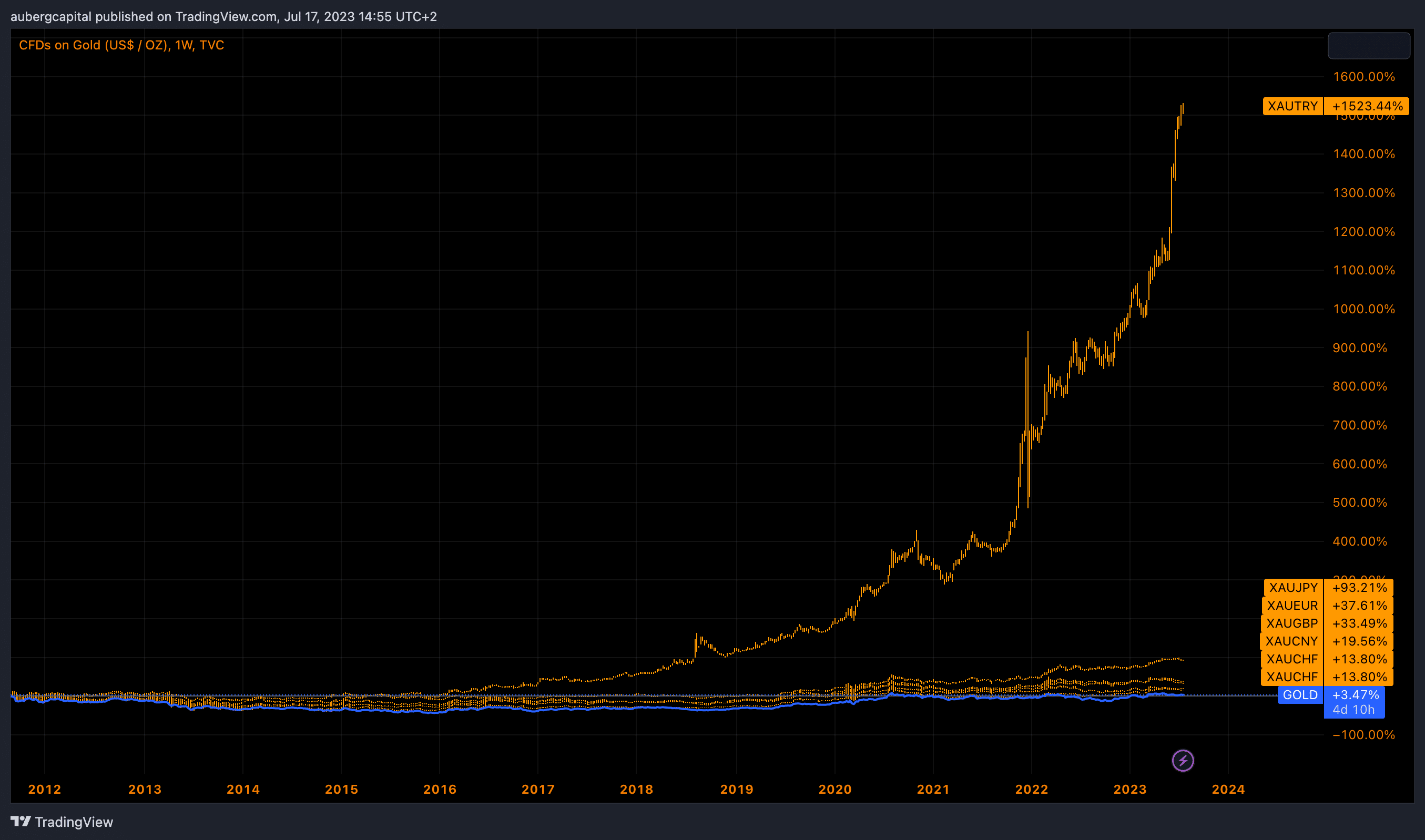

Gold priced in the different currencies gives the following returns:

So messages like this are pretty misleading if you ask me. It is therefore also important to price gold in the currency of the country where you live, or in which currency you express your net worth. Suppose I liquidate all my assets, then I have that in euros, because I live in The Netherlands. We also do not price Nvidia shares in Turkish liras, for example, so why would you as a European express the gold price in US Dollars?

If we price rough rice (rice) futures in gold, we see that an agricultural commodity remains relatively stable, in fact our purchasing power has risen sharply. For example, for 1 metric ton (1,000 kilos) you paid about 1 ounce of gold in 2000 ($250).

In 2023, the value of a ton of rice is only worth 0.3 ounces of gold, while if we price rice futures in US Dollars, rice has increased in value by 137% since then. Then you immediately know why it is so important to price assets in the right currency.

Physical gold has yielded an average return of 9% per year over the last 20 years. This makes gold one of the best performing assets. When investing in gold, make sure you buy gold safely with a buyback guarantee at a fixed price. You are assured of this with the Doijer & Kalff account.

Views based on published articles or news items are purely informative. The non-binding information should not be perceived as an offer, investment advice or any other financial service.

Sign up now for our newsletter and receive daily updates on precious metals, our discounts and articles.